Are Changes Ahead for Retirement Accounts?

Are Changes Ahead for Retirement Accounts? A bill now in Congress proposes to alter some longstanding rules. Provided by Marc Aarons at Money Managers, Inc. Most Americans are not saving enough for retirement, despite ongoing encouragement to do so (and recurring warnings about what may happen if they do not). This year, lawmakers are also […]

Leaving a Legacy to Your Grandkids

Leaving a Legacy to Your Grandkids Now is the time to explore the possibilities. Provided by Marc Aarons @ Money Managers, INC. Grandparents Day provides a reminder of the bond between grandparents and grandchildren and the importance of family legacies. A family legacy can have multiple aspects. It can include much more than heirlooms […]

Save & Invest Even if Money Is Tight

Save & Invest Even if Money Is Tight For millennials, today is the right time. Provided by Marc Aarons at Money Managers Inc. If you are under 30, you have likely heard that now is the ideal time to save and invest. You know that the power of compound interest is on your side; you […]

Why Do People Put Off Saving for Retirement?

A lack of money is but one answer. Provided by Marc Aarons @ Money Managers, Inc. Common wisdom says that you should start saving for retirement as soon as you can. Why do some people wait decades to begin? Nearly everyone can save something. Even small cash savings may be the start of something big […]

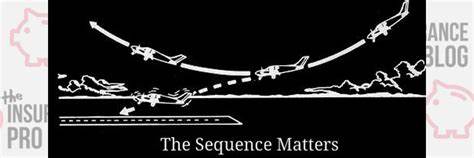

The Sequence of Returns

A look at how variable rates of return do (and do not) impact investors over time. Provided by Marc Aarons @ Money Managers, Inc. What exactly is the “sequence of returns”? The phrase simply describes the yearly variation in an investment portfolio’s rate of return. Across 20 or 30 years of saving and investing for […]

Before You Claim Social Security

A few things you may want to think about before filing for benefits. Provided by Marc Aarons @ Money Managers, Inc. Whether you want to leave work at 62, 67, or 70, claiming the retirement benefits you are entitled to by federal law is no casual decision. You will want to consider a few key […]

Ways to Repair Your Credit Score

Steps to get your credit rating back toward 720. Provided by Marc Aarons @ Money Managers Inc. We all know the value of a good credit score. We all try to maintain one. Sometimes, though, life throws us a financial curve and that score declines. What steps can we take to repair […]

Is It Time to Stop Procrastinating About Your Financial Plan?

Some things to think about as you get started with your strategy. Provided by Marc Aarons @ Money Managers, Inc. First, look at your expenses and your debt. Review your core living expenses (such as a mortgage payment, car payment, etc.). Can any core expenses be reduced? Investing aside, you position yourself to gain ground […]

Do You Know Who Your Beneficiaries Are?

Why you should periodically review beneficiary designations. Provided by Marc Aarons @ Money Managers, Inc. Your beneficiary choices may need to change with the times. When did you open your first IRA? When did you buy your life insurance policy? Are you still living in the same home and working at the same job as […]

How Much Do You Really Know About Long-Term Care?

Separating some eldercare facts from some eldercare myths. Provided by Marc Aarons Marc@ocmoneymanagers.com How much does eldercare cost, and how do you arrange it when it is needed? The average person might have difficulty answering those two questions, for the answers are not widely known. For clarification, here are some facts to dispel some myths. […]