Retirement Questions That Have Nothing to Do With Money

Retirement Questions That Have Nothing to Do With Money Think about these matters before you leave work for the last time. Provided by Marc Aarons @ Money Managers, Inc. Retirement planning is not entirely financial. Your degree of happiness in your “second act” may depend on some factors you cannot quantify. Here are a few […]

How the Tax Reforms Will Take Effect

Some of the impact of the Tax Cuts & Jobs Act will be felt later than January 1. Provided by Marc Aarons at Money Managers, Inc. President Donald Trump signed the Tax Cuts & Jobs Act into law on December 22, and on January 1, some key details of the Internal Revenue Code will abruptly […]

Congress Passes the Tax Cuts & Jobs Act

What will the near-term impact be? Provided by Marc Aarons @ Money Managers Inc. On December 20, Congress passed the Tax Cuts & Jobs Act, sending the final version of the GOP tax reform bill to President Trump’s desk. The legislation alters the Internal Revenue Code to a degree unseen since the 1980s, altering income […]

Comprehensive Financial Planning: What It Is, Why It Matters

Your approach to building wealth should be built around your goals & values. Provided by Marc Aarons @ Money Managers Inc. Just what is comprehensive financial planning? As you invest and save for retirement, you may hear or read about it – but what does that phrase really mean? Just what does comprehensive financial planning […]

Now 64? Prepare to Sign Up for Medicare.

This is the time to arrange lifelong health coverage. Provided by Marc Aarons @ Money Managers, Inc. Age 64 is the age when you are reminded that you are a baby boomer growing older. Regardless of how young or old you feel at 64, you should make sure to sign up for Medicare. The […]

Should We Reconsider What “Retirement” Means?

The notion that we separate from work in our sixties may have to go. Provided by Marc Aarons @ Money Managers, Inc. An executive transitions into a consulting role at age 62 and stops working altogether at 65; then, he becomes a buyer for a church network at 69. A corporate IT professional decides to […]

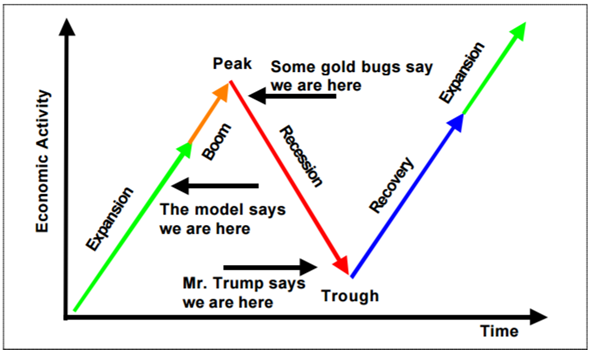

When Will the Business Cycle Peak?

As the recovery lengthens further, this is a natural question to ask. Provided by Marc Aarons @ Money Managers, Inc This decade has brought a long economic rebound to many parts of America. As 2017 ebbs into 2018, some of the statistics regarding this comeback are truly impressive: *Payrolls have grown, month after month, […]

Year-End Charitable Gifting

What should you keep in mind as you donate? Provided by Marc Aarons @ Money Managers, Inc. Are you making charitable donations this holiday season? If so, you should know about some of the financial “fine print” involved, as the right moves could potentially bring more of a benefit to the charity and to […]

Your 2018 Financial To-Do List

Things you can do for your future as the year unfolds. Provided by Marc Aarons @ Money Managers, Inc What financial, business, or life priorities do you need to address for 2018? Now is a good time to think about the investing, saving, or budgeting methods you could employ toward specific objectives, from […]

The Republican Tax Reform Plan

What is in it? What could its changes mean for you, if they become law? Provided by Marc Aarons @ Money Managers, Inc. Major changes may be ahead for federal tax law. At the start of November, House Republicans rolled out their plan for sweeping tax reforms. Negotiations may greatly alter the content of […]