2020 IRA Deadlines Are Approaching

Here is what you need to know. Provided by Marc Aarons Financially, many of us associate April with taxes – but we should also associate April with important IRA deadlines. April 15, 2021 is the deadline to take your Required Minimum Distribution (RMD) from certain individual retirement accounts. Keep in mind that withdrawals from traditional, […]

Navigating Your Required Minimum Distribution

Understand the IRS’s calculations and tables. Provided by Marc Aarons As much as you would like to, you can’t keep your money in your retirement account forever. These investment vehicles include 401(k)s, IRAs, and similar retirement accounts.1 Under the SECURE Act, once you reach age 72, you must begin taking required minimum distributions from your […]

Building a Healthy Financial Foundation

How many pieces do you have in place? Provided by Marc Aarons When you read about money matters, you will sometimes see the phrase, “getting your financial house in order.” What exactly does that mean? When your financial “house is in order,” it means it is built on a solid foundation. It means that you […]

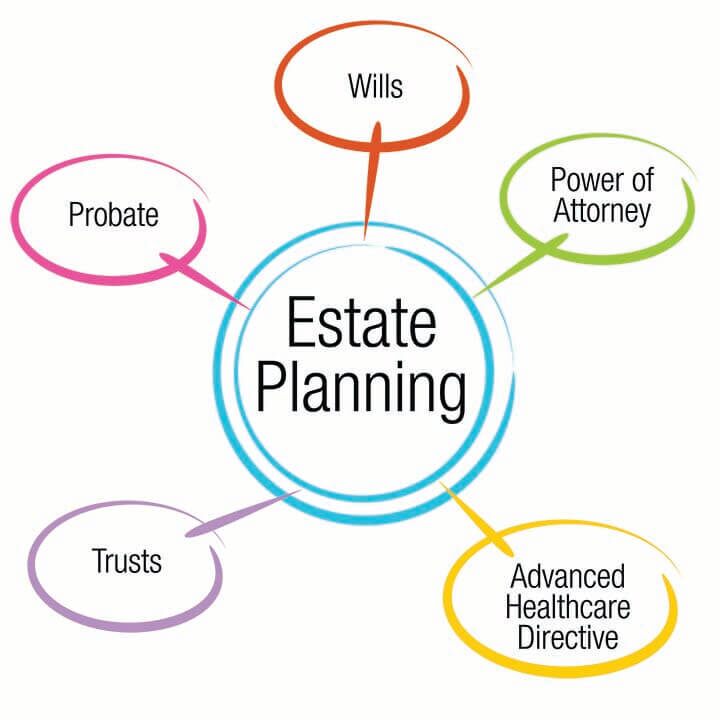

Year-End Estate Strategies

What you need to know to get ready for the end of the year. Provided by Marc Aarons With one year ending and a new one on the cusp of starting, many people will consider their resolutions—not their estate strategy. But the end of the year is a great time to sit down and review […]

Why Roth IRA Conversions May Now Be Advantageous

Thanks to a couple of factors, some investors are thinking about this move before 2020 ends. Provided by Marc Aarons Roth IRAs have attracted retirement savers since their introduction in 1998. They offer the potential for tax-free retirement income, provided Internal Revenue Service rules are followed. Do Roth IRAs seem even more attractive these days? […]

The I.R.S. Has Enhanced the 2020 RMD Waivers

Investors may be eligible to “undo” certain retirement account withdrawals before September. Provided by Marc Aarons In March, the Coronavirus Aid, Relief, and Economic Security (CARES) Act became law. It was designed to help Americans impacted by the COVID-19 pandemic.1 The new law offered investors a financial break. It gave people the option to skip […]

The Pros and Cons of Early Retirement Plan Rollovers

Should you withdraw and reinvest your retirement plan money while you are still on the job? Provided by Marc Aarons Did you know you might be able to take some or all of the money in your 401(k), 403(b), or 457 plan and roll it over into another type of retirement account? Were you aware […]

New I.R.S. Contribution Limits

A look at the maximum amounts you can put into retirement accounts this year. Provided by Marc Aarons at Money Managers, Inc. The I.R.S. just announced the annual contribution limits on IRAs, 401(k)s, and other widely used retirement plan accounts for 2020. Here’s a quick look at them. *Next year, you can put up to […]

That First RMD from Your IRA

What you need to know. Provided by Marc Aarons at Money Managers, Inc. When you reach age 70½, the Internal Revenue Service instructs you to start making withdrawals from your traditional IRA(s). These withdrawals are also called Required Minimum Distributions (RMDs). You will make them, annually, from now on.1 If you fail to take […]

IRA Withdrawals That Escape the 10% Penalty

The list of these options has grown. Provided by Marc Aarons at Money Managers, Inc. An IRA, or Individual Retirement Account, is a tax-advantaged savings account that is subject to special rules regarding contributions and withdrawals. One of the central rules of IRAs is that withdrawals prior to age 59½ are generally subject to a […]