Fed Chair Changes His Tune

Powell’s testimony to Congress may be telling. Provided by Marc Aarons If you weren’t paying close attention, you might have missed it. Fed Chair Jerome Powell dropped the word “transitory” when describing inflation during his recent testimony to Congress.1 Powell had told the story of transitory inflation for the past several months while the Consumer […]

Powell News Kicks Off Volatile Season?

These numbers don’t always represent the full picture. Provided by Marc Aarons The holiday season is often a quiet, positive time for the financial markets. The phrase “Santa Claus Rally” was coined in the early 1970s to reflect the stock market’s upward bias during the November-January stretch.1 But this year, the markets might face some […]

The Power of the Consumer

In recent months, consumer confidence has been falling. Provided by Marc Aarons A confident consumer can be a powerful ally in an economy. But when the consumer starts to have questions, we can measure consumer confidence in everything from retail sales to home buying to the personal savings rate. In recent months, consumer confidence has […]

Is Inflation Peaking?

One lesser-known indicator is called the Baltic Dry Index. Provided by Marc Aarons You see it in prices at the grocery store and the gas station. You feel it in your monthly budget. So why don’t the financial markets seem too concerned about inflation? Remember, financial markets are considered “discounting mechanisms,” meaning they are looking […]

2022 Contribution Limits

Is it time to contribute more? Provided by Marc Aarons Preparing for retirement just got a little more financial wiggle room. This week, the Internal Revenue Service (IRS) announced new contribution limits for 2022. Staying put for 2022 are traditional Individual Retirement Accounts (IRAs), with the limit remaining at $6,000. The catch-up contribution for traditional […]

FANNG is now MAMAA

Wise investors take the “big picture” view. Provided by Marc Aarons CNBC’s Mad Money host Jim Cramer created the popular FAANG acronym to denote some of the largest, most powerful companies in the world: Facebook, Amazon, Apple, Netflix, and Google. Recently, changes in those companies are reflected in Cramer’s new acronym: MAMAA, which stands for […]

Tax Changes: What’s In, What’s Out?

While some initiatives are left behind, others are seeing renewed interest. Provided by Marc Aarons While it’s still too early to draw any final conclusions, Congress is getting closer to outlining what tax law changes are under consideration to pay for the proposed $1.75 trillion Build Back Better Plan.1 For now, it appears that changes […]

Wise Decisions with Retirement in Mind

Certain financial & lifestyle choices may lead you toward a better future. Provided by Marc Aarons Some retirees succeed at realizing the life they want; others don’t. Fate aside, it isn’t merely a matter of investment decisions that makes the difference. There are certain dos and don’ts – some less apparent than others – that […]

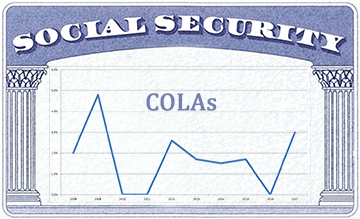

The Social Security Administration Announces 2022 COLA

5.9% is the biggest COLA increase in decades. Provided by Marc Aarons On October 13, 2021, the Social Security Administration (SSA) officially announced that Social Security recipients will receive a 5.9 percent cost-of-living adjustment (COLA) for 2022, the largest increase in four decades. This adjustment will begin with benefits payable to more than 64 million […]

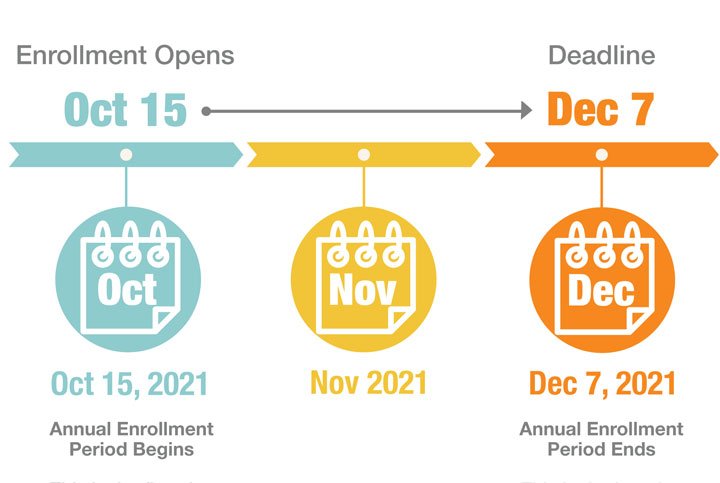

Ready for Medicare Open Enrollment?

Enrollment period begins October 15. Provided by Marc Aarons Medicare’s annual open enrollment period begins October 15 and ends December 7. During this time, current Medicare beneficiaries have the option to adjust their coverage for the coming year. Any changes to your plan will go into effect on January 1, 2022.1 This is an opportunity […]