OCTOBER FINANCIAL MARKET UPDATE

OCTOBER FINANCIAL MARKET UPDATE I hope this email finds you well! Long-term investors with diversified portfolios had a solid month in September, as the S&P 500 rose for three consecutive weeks. As a bonus, the recent stock index rally was further fueled by a Federal Reserve (Fed) that delivered on a 50-basis-point rate cut. With […]

Financial Considerations for College Students and Parents

I hope this finds you well today. If you or someone in your network is a parent of one of the over 18 million students headed off to begin or continue their undergraduate studies this fall, I want to highlight an important aspect that often arises during this time of year: financial considerations for college […]

Proactive Tax Strategies – Businesses

Proactive Tax Strategies – Business Presented by Marc Aarons We made it through another tax season, but that doesn’t mean our work is done! In fact, now is the perfect time for businesses to consider the practices that increase tax efficiency and augment readiness for any scrutiny, such as audits. Here are some […]

Education Tax Deductions and Credits

Education Tax Deductions and Credits Presented by Marc Aarons With many students heading off to college this month, I wanted to take this opportunity to share an overview of key education tax credits and deductions. Feel free to share this email with anyone you think may benefit from this information, and do not hesitate to […]

Monday Market Events Overview August 5th 2024

Monday Market Events Overview August 5th 2024 Presented by Marc Aarons I hope all is well with you. As you may know, the S&P 500 had its worst day in almost two years on Monday, August 5, as stocks fell in response to weak international and U.S. economic data. I imagine you may have questions […]

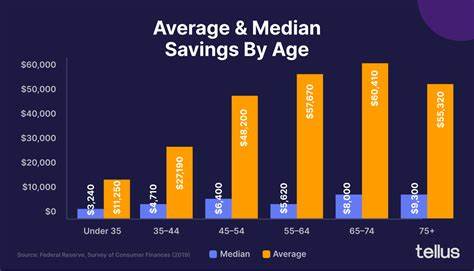

Recommended Savings By Age

Recommended Savings By Age Presented by Marc Aarons If you’ve ever played around with online retirement calculators, saving for retirement can be a serious exercise in sticker shock. The good news is a thoughtful financial plan can place you on the right trajectory, eliminate unnecessary worry, and free you to live while your money works […]

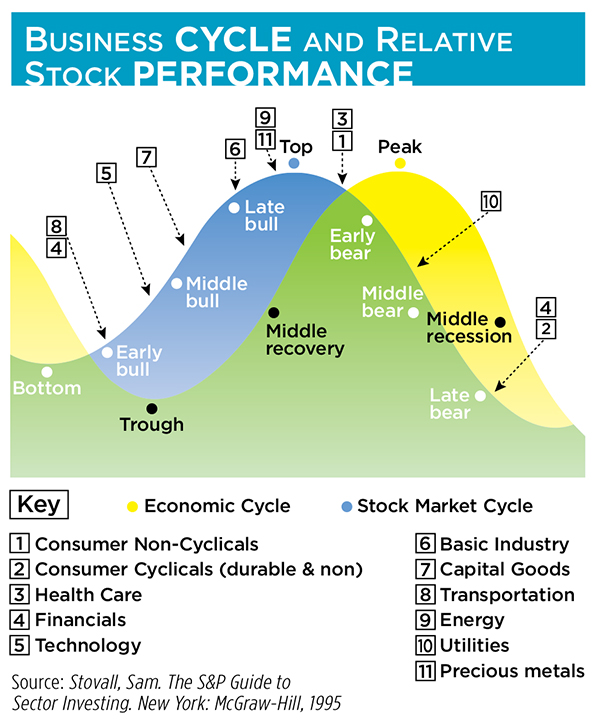

Recession Advice for Small Businesses

Recession Advice for Small Businesses Presented by Marc Aarons I wanted to reach out today to see how you’re feeling, given the wave of news about a potential recession and its impact on small businesses like yours. If you find yourself increasingly concerned, you’re not alone — 93% of small business owners are. The […]

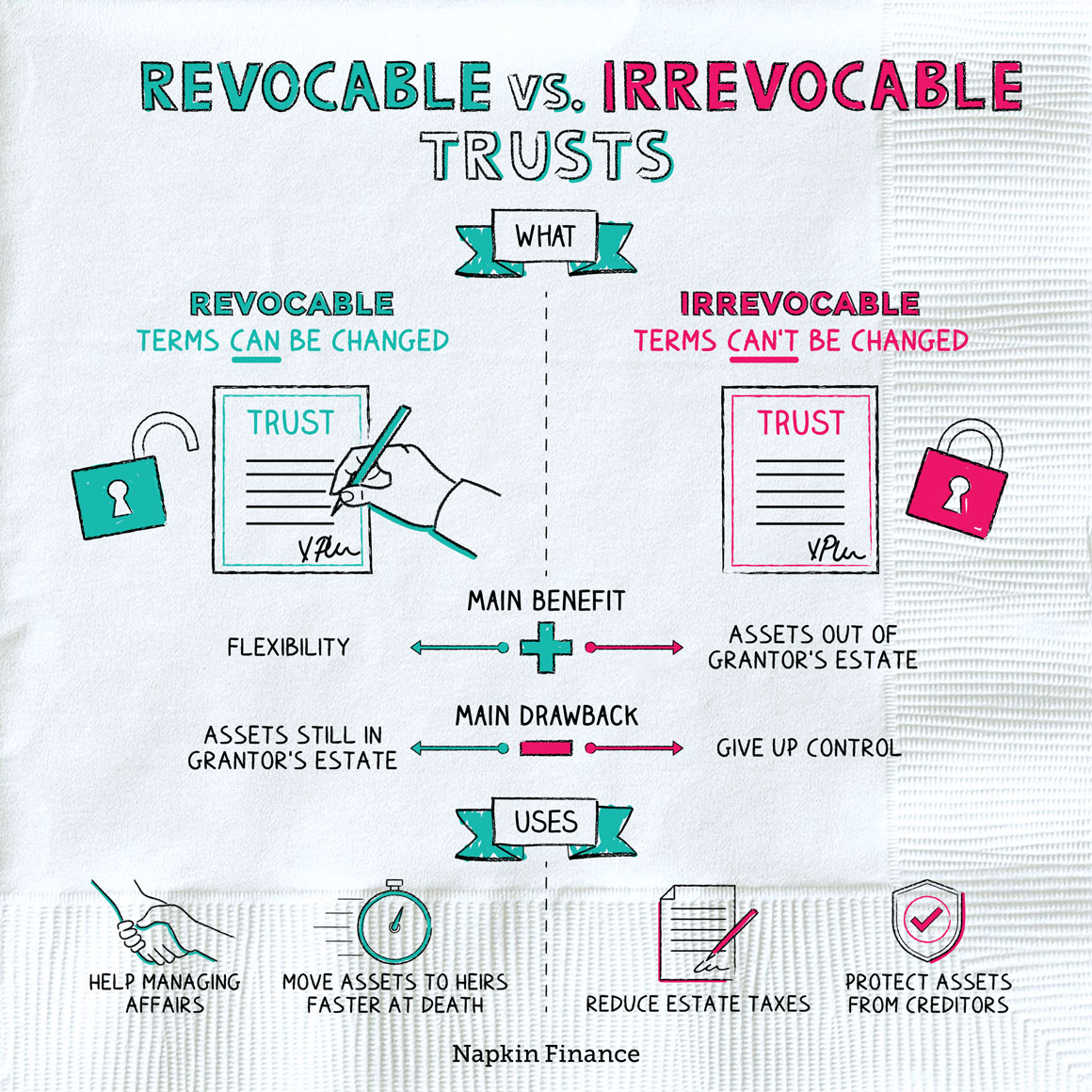

Revocable vs. Irrevocable Trusts

Revocable vs. Irrevocable Trusts Presented by Marc Aarons If you’re anything like me, you’ve been thinking about the future. I take pride in helping people make the most of what they have and earn, which is why I’m writing to clarify some info on trusts. Contrary to popular belief, trusts can be quite a […]

Financial Considerations for College Students and Parents

Financial Considerations for College Students and Parents Presented by Marc Aarons If you or someone in your network is a parent of one of the over 18 million students headed off to begin or continue their undergraduate studies this fall, I want to highlight an important aspect that often arises during this time of year: […]

Retirement- Should You Leave Your 401(k) With Your Employer?

Retirement- Should You Leave Your 401(k) With Your Employer? Presented by Marc Aarons I thought I’d quickly reach out about an interesting trend I’ve seen with my retiring clients. More and more plans are offering retirees the option of keeping their funds in their employer-sponsored 401(k) upon retirement. Since this is relatively new, I […]