© 2026 Money Managers, Inc.

Posts about retirement

A Retirement Fact Sheet

Some specifics about the “second act.” Provided by Marc Aarons at Money Managers, INC. Does your vision of retirement align with the facts? Here are some noteworthy financial and lifestyle facts about life after 50 that might surprise you. Up to 85% of a retiree’s Social Security income can be taxed. Some retirees are […]

Is Generation X Preparing Adequately for Retirement?

Future financial needs may be underestimated. Provided by Marc Aarons at Marc@OcMoneyManager.com If you were born during 1965-80, you belong to “Generation X.” Ten or twenty years ago, you may have thought of retirement as an event in the lives of your parents or grandparents; within the next 10-15 years, you will probably be […]

When You Retire Without Enough

Start your “second act” with inadequate assets, and your vision of the future may be revised. Provided by Marc Aarons at Money Managers, Inc. How much have you saved for retirement? Are you on pace to amass a retirement fund of $1 million by age 65? More than a few retirement counselors urge pre-retirees […]

Debunking a Few Popular Retirement Myths

It seems high time to dispel some of these misconceptions. Provided by Marc Arrons at Money Managers, Inc. Generalizations about money and retirement linger. Some have been around for decades, and some new clichés have recently joined their ranks. Let’s examine a few. “When I’m retired, I won’t really have to invest anymore.” Society still […]

The IRA and the 401(k)

Comparing their features, merits, and demerits. Provided by: Marc Aarons at Money Managers Inc. How do you save for retirement? Two options probably come to mind right away: the IRA and the 401(k). Both offer you relatively easy ways to build a retirement fund. Here is a look at the features, merits, and demerits of […]

5 Retirement Concerns Too Often Overlooked

Baby boomers entering their “second acts” should think about these matters. Provided by: Marc Aarons at Money Managers, Inc. Retirement is undeniably a major life and financial transition. Even so, baby boomers can run the risk of growing nonchalant about some of the financial challenges that retirement poses, for not all are immediately obvious. In […]

Are Changes Ahead for Retirement Accounts?

Are Changes Ahead for Retirement Accounts? A bill now in Congress proposes to alter some longstanding rules. Provided by Marc Aarons at Money Managers, Inc. Most Americans are not saving enough for retirement, despite ongoing encouragement to do so (and recurring warnings about what may happen if they do not). This year, lawmakers are also […]

Why Do People Put Off Saving for Retirement?

A lack of money is but one answer. Provided by Marc Aarons @ Money Managers, Inc. Common wisdom says that you should start saving for retirement as soon as you can. Why do some people wait decades to begin? Nearly everyone can save something. Even small cash savings may be the start of something big […]

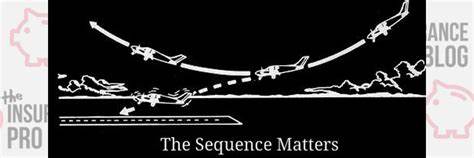

The Sequence of Returns

A look at how variable rates of return do (and do not) impact investors over time. Provided by Marc Aarons @ Money Managers, Inc. What exactly is the “sequence of returns”? The phrase simply describes the yearly variation in an investment portfolio’s rate of return. Across 20 or 30 years of saving and investing for […]

Before You Claim Social Security

A few things you may want to think about before filing for benefits. Provided by Marc Aarons @ Money Managers, Inc. Whether you want to leave work at 62, 67, or 70, claiming the retirement benefits you are entitled to by federal law is no casual decision. You will want to consider a few key […]

Money Managers, Inc. is registered in the required states with the state regulatory authority. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities, and past performance is not indicative of future results. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. View our disclosures page HERE.

A Financial Planning & Tax Accounting Firm