© 2025 Money Managers, Inc.

Posts about social security

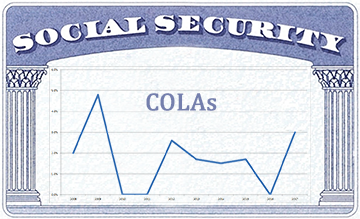

The Social Security Administration Announces 2022 COLA

5.9% is the biggest COLA increase in decades. Provided by Marc Aarons On October 13, 2021, the Social Security Administration (SSA) officially announced that Social Security recipients will receive a 5.9 percent cost-of-living adjustment (COLA) for 2022, the largest increase in four decades. This adjustment will begin with benefits payable to more than 64 million […]

A 6.1% Bump in Social Security?

COLA and Social Security. Provided by Marc Aarons The news keeps getting better for Social Security recipients. It’s now projected that benefits will increase 6.1% in 2022, up from the 4.7% forecast just two months ago. That would be the most significant increase since 1983.1,2 It’s all about inflation. Social Security cost of living adjustments […]

A COLA with Your Social Security?

Preliminary estimates call for a 4.7% cost-of-living increase.1 Provided by Marc Aarons If there is a “silver lining” to all the inflation talk, it may be that Social Security benefits are expected to see a larger-than-normal increase in 2022. Preliminary estimates call for a 4.7% cost-of-living increase (COLA) in Social Security benefits next year, which […]

How and When to Sign Up for Medicare

Breaking down the enrollment periods and eligibility. Provided by Marc Aarons Medicare enrollment is automatic for some. For those receiving Social Security benefits, the coverage starts on the first day of the month you turn 65.1 If you are not receiving Social Security benefits at 65, you may be delaying until you reach full retirement […]

Before You Claim Social Security

A few things you may want to think about before filing for benefits. Provided by Marc Aarons Whether you want to leave work at 62, 67, or 72, claiming the retirement benefits you are entitled to by federal law is no casual decision. You will want to consider a few key factors first. How long […]

A Retirement Fact Sheet

Some specifics about the “second act.” Provided by Marc Aarons at Money Managers, Inc. Does your vision of retirement align with the facts? Here are some noteworthy financial and lifestyle facts about life after 50 that might surprise you. Up to 85% of a retiree’s Social Security income can be taxed. Some retirees […]

Reducing the Risk of Outliving Your Money

What steps might help you sustain and grow your retirement savings? Provided by Marc Aarons at Money Managers, Inc. “What is your greatest retirement fear?” If you ask any group of retirees and pre-retirees this question, “outliving my money” will likely be one of the top answers. In fact, 51% of investors surveyed for a […]

Could Social Security Really Go Away?

That may be unlikely, but the program does face financial challenges. Provided by Marc Aarons and Money Managers, Inc. Will Social Security run out of money in the 2030s? You may have heard warnings about this dire scenario coming true. These warnings, however, assume that no action will be taken to address Social Security’s financial […]

Where Will Your Retirement Money Come From?

Retirement income may come from a variety of sources. Provided by Marc Aarons at Money Managers, Inc. For many people, retirement income may come from a variety of sources. Here’s a quick review of the six main sources: Social Security. Social Security is the government-administered retirement income program. Workers become eligible after paying Social Security […]

When a Family Member Dies

A financial checklist for the most difficult of times. Provided by Marc Aarons at Money Managers, Inc. The passing of a loved one irrevocably alters family life. After a death, there is so much to attend to; it is better to do it sooner rather than later. Here, then, is a list of what commonly […]

Money Managers, Inc. is registered in the required states with the state regulatory authority. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities, and past performance is not indicative of future results. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. View our disclosures page HERE.

A Financial Planning & Tax Accounting Firm